Southwest Gas Holdings (SWX) - Bullish Nevada & Arizona. Rate Base Growth Drives EPS Higher.

Date: 6/24/24

Company: Southwest Energy Corporation

Ticker: SWX

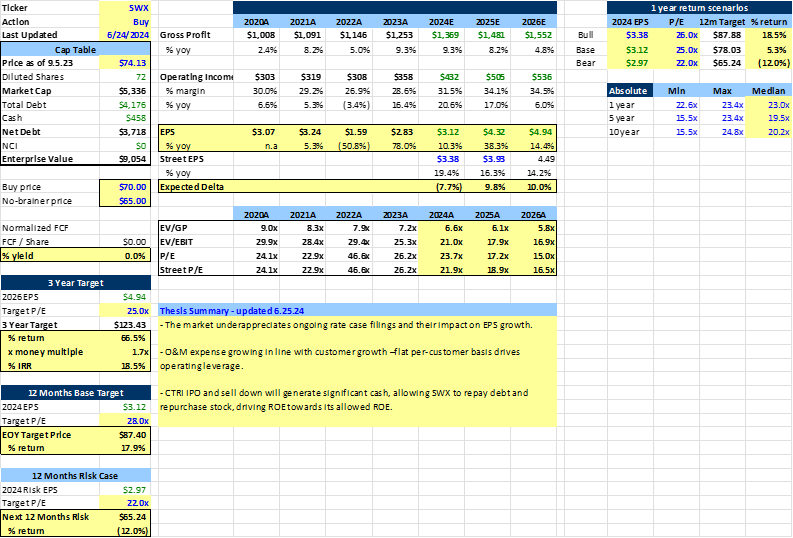

Note – The following tables and estimates exclude Centuri’s business, which consensus estimates includes.

Model

Definitions – Utility Industry

Rate-Setting: Utilities generate revenue primarily through the rates they charge customers for electricity, gas, water, or other services. These rates are set through a regulatory process to ensure they are fair and sufficient to cover costs and provide a reasonable return on investment.

Cost Recovery: Rates are designed to allow utilities to recover the costs of providing service, including operating expenses, maintenance, fuel costs, and capital expenditures for infrastructure.

Capital Investments: Utilities invest heavily in infrastructure, such as power plants, transmission lines, and distribution networks. These capital investments are added to the rate base, the value of which is used to determine the rates charged to customers.

Rate Base: The rate base is the value of the utility's invested capital (infrastructure, equipment, etc.) on which it is allowed to earn a return.

Allowed ROE: Utilities are permitted to earn a return on equity. Regulatory commissions set the allowed ROE, representing the return investors require to compensate for the risk of investing in the utility. This return is typically a spread over the utility's bond rate.

Background

Southwest Gas Holdings, Inc. provides natural gas distribution and transmission service to over 2.2m customers in AZ, NV, and CA through its primary operating subsidiary, Southwest Gas Corporation. The company also holds an 81% majority stake in Centuri Holdings, Inc., which IPO'd on 4/17/24 and provides infrastructure construction services across North America. In February 2023, Southwest sold its pipeline and storage company to Williams (WMB) for $1.5B. Over the past several years, management has transformed Southwest from a natural gas distribution operations, utility infrastructure services, and pipeline and storage to a pure-play, natural gas distribution utility. Southwest has a line of sight to pay off $600m of parent debt, initiate buybacks, and/or increase the dividend.

Southwest Energy is currently in the process of rate case filings in Arizona, California, and the Great Basin, which, if successful, could lead to substantial rate base growth in the coming years. Despite management's conservative guidance of 6.5%-7.5% rate base growth from 2024-2026, I anticipate their authorized rate base to grow at a more optimistic ~8% during this period. The company's history of setting low bars and favorable geographic locations further supports this positive outlook, which is expected to drive healthy gross profit growth over the next decade.

Note – Since a utility is allowed to make a certain ROI, revenue and cost of goods fluctuate with the price of natural gas and are not indicative of the actual revenue generation or cost structure of the business as higher/lower natural gas prices are passed through to the consumer.

Business

Southwest purchases, distributes and transports natural gas for customers in portions of Arizona, Nevada, and California. Southwest is the largest distributor of natural gas in Arizona and Nevada, and it distributes and transports natural gas to customers in portions of California. Additionally, Southwest operates two regulated interstate pipelines serving portions of Nevada and California through its subsidiaries. Southwest acquires natural gas from various sources with a mix of purchase provisions, including spot market and firm supplies. Purchase terms range from one day to several years, utilizing fixed and indexed pricing. In 2023, Southwest acquired natural gas from 48 suppliers.

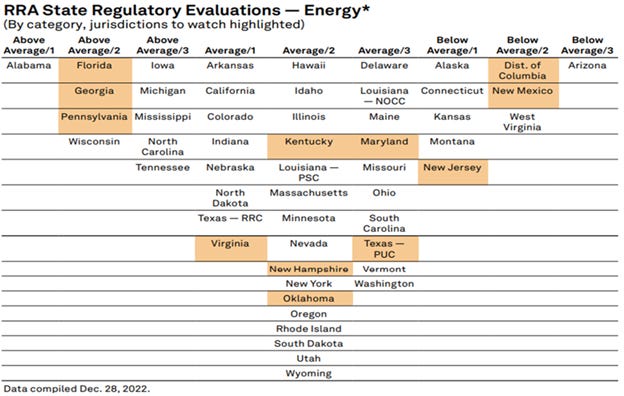

Southwest is subject to regulation by the Arizona Corporation Commission (the "ACC"), the Public Utilities Commission of Nevada (the "PUCN"), and the California Public Utilities Commission (the "CPUC"). These commissions regulate public utility rates, practices, facilities, and service territories in their respective states. Business is seasonal, with demand greatest in the coldest months of the year, Q1 & Q4.

The utility industry is a political nightmare, where government officials must balance the capital investments required to ensure a stable and quality grid, offset by the upheaval residents cause when their utility bills increase. A guaranteed way to get voted out of office is to have constant blackouts, which must be balanced with not having customers feel like they are being taken advantage of. The jurisdictions mentioned before, the Arizona Corporation Commission, Public Utilities Commission, and so on, are responsible for setting the maximum return utility earns. Since utilities operate as a monopoly in their geographic regions, regulations are implemented to ensure consumers are not taken advantage of to allow for a maximum Return on Equity, Leverage Ratio, and Asset Base (Rate base), which these metrics can be measured against.

At the end of Q1, 24 Southwest had 2.235m residential, commercial, industrial, and other natural gas customers, of which 1.197m were in Arizona, 832,000 in Nevada, and 206,000 in California. Trailing Twelve-month (TTM) first-time meter sets were approximately 40,000.

Residential and commercial revenues comprised 94% of revenues in 2023, with residential comprising 69%.

Thesis

The key to Southwest Energy's revenue and EPS growth lies in three areas: Rate base growth, increasing authorized rate of return, and increased leverage allowed. Typically, authorized ROE (a combination of allowed leverage and rate of return) does not change significantly from year to year, barring changes in a utility’s cost of capital. With the rise in interest rates, ROEs have seen a boost in most Southwest markets. Looking ahead, the most promising growth driver is rate-based growth. Rate base, which includes the original cost of the utility plant in service, adjusted for third-party costs, working capital, inventories, and certain other assets, is a strong indicator of Southwest Energy's growth potential.

Nevada, particularly Las Vegas, a market Southwest provides energy for, is in the midst of transitioning from a nightlife and party destination to a sports and entertainment destination with a significantly larger audience. The addition of the Raiders, Golden Nights, soon-to-be Oakland Athletics, and, shortly, an NBA expansion team. In addition, the Sphere attracts visitors to see their favorite bands in the most incredible entertainment venue in the world. This increases the demand for electricity as the venues need power. In addition, as more visitors come to Vegas, more rooms are occupied, increasing energy utilization. As an aside, during a trip to Vegas for the Consumer Electronics show earlier this year, the concerns friends/family had were crime and homelessness. While this was an n=1, Vegas seemed as safe and clean as any other city. Removing previous concerns surrounding the strip increases future demand.

Vegas suburbs continue to see population growth over the national average. Nevada1 is currently the fifth-fastest-growing state in the United States. Between 2010 and 2023, Nevada's population increased by 19.45%, and its 2023 growth rate is an estimated 1.27%. The highest percentage of new Nevada residents migrated from California, followed by Texas, Arizona, and other western states. Since 2020, Nevada has been the 14th fastest-growing state in the US. The rising population increases future energy demand.

The table below details Rate Base growth from 2020 to today. In April 2024, the Southern Nevada rate base increased 16% to $1.78B, while Northern Nevada increased ~30% to $227m. Southwest will need to reinvest in the business as the population grows, driving rate base growth and increasing net income.

Arizona accounts for the largest portion of SWX's rate base, at $2.6B, representing 53%. Arizona was the ninth-fastest growth from 2010 to 2023 (as well as from 2020-2023), with the population increasing from 6,392,017 in 2010 to 7,379,346 in 2023, a 15.45% increase in population.

With the baby boomers retiring and desiring better (warmer) climate conditions, while yes, the summers are scorching in both Nevada and Arizona, I expect the southern migration to continue. Arizona's population is expected to grow 4.4% from 2025 to 20302, while Nevada's is estimated to grow at 5.7% from 2025 to 20303. The Census Bureau estimates the US population is expected to grow at ~3% between that time4. Faster than-average population growth is a growth tailwind for SWX. In addition, projects like TSMC's new Phoenix FAB are another driver of revenue growth. According to Forbes, Nevada ranks 13th, and Arizona ranks 18th in the best states for business5.

Most corporations are registered in Delaware due to its sophisticated legal system, strong shareholder protections, and flexibility in corporate governance. Ideal for companies seeking legal certainty and a well-established body of corporate case law. Nevada offers a more business-friendly environment with strong liability protections, greater privacy, and a more straightforward incorporation process. Suitable for companies looking to minimize regulatory requirements and personal liability for directors and officers. It's typically a red flag to see a company registered in Nevada, as shareholder protection is far less than Delaware registered company. For example, Nevada imposes a higher standard for proving breaches of fiduciary duty. Directors and officers are protected from personal liability unless there is clear evidence of intentional misconduct, fraud, or a knowing violation of law. This high threshold can make it difficult for shareholders to successfully sue management for actions that might be considered breaches of duty in other states. During Elon Musk's pay package suit, he tweeted, "I recommend incorporating in Nevada or Texas if you prefer shareholders to decide matters." A Delaware judge invalidated his $55.8 billion pay package as CEO of Tesla.

Weeks later, another billionaire with deepening ties to Nevada had an incorporation win. A Delaware judge ruled in late February that Tripadvisor Inc., the online review and booking site whose controlling shareholder is Formula One's Greg Maffei, could move its incorporation to the Silver State despite a legal challenge from shareholders6.

According to data from the Secretary of State's Office, more than 108,000 business entities were registered in Nevada in 2023, a roughly 150 percent increase from 2019. While small businesses make up much of the growth, industry, and state officials say the high-profile attention could bring more big names, additional state revenue, and maybe even a more diverse economy in the long term.

If more companies either move their headquarters or register their business in Nevada, larger companies may move there, increasing the energy demand. Another example of a large corporation moving to Nevada is the 500,000 sf Sony Pictures movie studio in Summerlin, NV. The $700m facility is expected to bring thousands of new jobs to the community7.

These markets have tailwinds, which will benefit Southwest Energy. From 2024-2026, management guided the total rate base to increase from 6.5% to 7.5% per year. This is likely conservative as they have cases to increase the rate base in every market over the next three years. As of April 2024, Nevada's rate base increased from $1.7B to ~$2.0B. In Q2, the effects of this increase will flow through the financial statements.

In February 2024, SWX filed a rate case in Arizona requesting an increase of ~$646m or a 24% increase, a request to increase the allowed ROE from 9.3% to 10.15% and a 0.81% fair value return on rate base, for an all in ROE of 10.96%. In Arizona, the rate base for utilities is typically calculated using the original cost method. However, they sometimes allow adjustments that bring the value closer to fair value, mainly when significant capital investments are made or during extraordinary circumstances. These adjustments may be reflected in mechanisms like the System Improvement Benefit (SIB) Mechanism. Should the full proposal go through(unlikely), the rate base and ROE increase are worth ~$126m in incremental revenue. I expect them to receive ~80% of their ask.

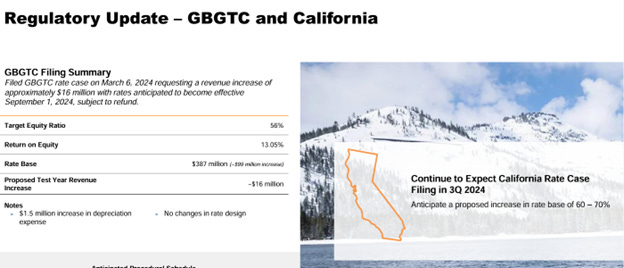

In California, SWX will file a rate case in Q3 2024 requesting a rate base increase of 60-70%. A decision will be made in mid-2025, which should translate to Q1 2026, seeing the effects of the increase in rate base. In March, they filed a rate case in the Great Basin Gas Transmission Company "GBGTC" requesting a $99m increase to $203m from $135m.

I expect the 2024 rate base to increase by 7.5% (high end of management's guide), with the growth coming from the rate base increase in Nevada and the GBGTC. In 2025, I expect the rate base to come in higher than the management's guide (they have a history of being conservative), growing ~10% y/y, led by growth in Arizona when a new rate base goes into effect in Q2 25. In 2026, rate base growth of 6.2% comes from growth in Soth Lake Tahoe (1% of total rate base) and significant growth in California.

Since 2020, operations and maintenance expenses, the most significant ongoing cost, increased from $406m to $511.6m in 2023 and from $191.4 to $229.6 per customer. Management's goal is to keep this cost flat per customer. If accomplished, this will result in significant operating leverage as customer growth is expected to grow LSD, combined with MSD-HSD gross profit growth, a substantial driver of EPS growth.

Looking solely at the utility business, I estimate SWX will grow EPS 10.3% in 2024, 38% in 2025, and 15% in 2026, driven substantially by rate base increase, operating leverage stemming from slower growing operations and maintenance expense, and buybacks from cash proceeds of CTRI stock (discussed more below). On $4.96 EPS in 2026 and a 25x multiple, I have a 3-year price target of $124, representing 66% upside and a three-year IRR of 18%. Upside(downside) stems from better(worse) than anticipated rate base fillings, the impact of CTRI stock, and stable operations and maintenance costs per customer.

PGA Balance

Differences between gas costs recovered from customers and the amounts paid for gas result in over- or under-collections. These balances are either retrieved from or refunded to customers with interest. The outstanding balance is recorded in the PGA balance. At the end of Q1 SWX has net recoverables of ~$200m, down from $553m in Q4 2023. This is the source of cash over the next several quarters. In Q1, interest income from the outstanding balance was ~$9.7m (included in other income) and will decline as cash is recovered from customers.

Centuri Spinoff

In April 2024, Southwest IPO'd its utility infrastructure services company, Centuri, at $21/share. Today, Southwest owns ~81% of the outstanding shares. They intend to reduce their ownership over time. They are currently subject to a six-month lockup period. October is the earliest they can begin to sell down their stake. Southwest had a US federal net operating loss carryforward of $1.03 billion, which could be available to offset a taxable gain incurred with the disposition of the Centuri stock. Management stated they expect to be able to offset a substantial portion of the taxable gains associated with selling Centuri stock (CTRI).

The position's value at ~$26 CTRI stock is ~$1.86B. With a $5.36B market cap, ~35% of today's SWX market value can be ascribed to their position in CTRI.

Accounting regulations require SWX to consolidate Centuri's operations due to the 81% ownership stake. However, given the recent IPO, it's more prudent to treat Southwest's natural gas distribution and Century's utility construction business separately.

While management hasn't directly stated they will sell down their stake in CTRI over the next several years, this is likely the course of action. After the six-month lockup, I expect a series of secondary transactions.

Southwest currently has ~$5.3, $3.6 of which is Southwest Gas Corp, $644m of Southwest Holding—parent company debt—and $1.1B of debt at Centuri. CTRI used IPO proceeds (April 2024) to pay down debt; thus, the $1.1B figure is lower today. SWX's gross debt, excluding CTRI's, is $4.176B; further factoring in the $1.86B CTRI position and $458m of cash brings net debt to ~$1.8B.

Southwest Gas Holdings (parent company) has $600m of corporate debt, which I expect to be paid off first with the initial sell-down of CTRI stock. This capital structure puts SWX below its allowed 50/50 debt/equity structure. Therefore, they could either raise the dividend or, more preferably, repurchase stock. I expect them to do a mix of both, with buybacks done in the near term and dividend increases over the long term. In addition, PGA balance recoveries could aid in any debt paydown or capital return.

Catalyst

Capital allocation priorities—After the six-month CTRI lockup ends, management should communicate the timeline for using the proceeds.

Arizona rate base case filing outcome. The rate case was filed in February 2024 and is expected to become effective in April 2025.

California rate case filing: Will be filed in Q3 2024, with a proposed rate base increase of 60-70%.

Carl Icahn owns ~15.4% of the shares. He is one of the key reasons behind the recent corporate actions.

· Icahn strongly opposed Southwest Gas's decision to acquire Questar Pipelines, a subsidiary of Dominion Energy, for approximately $2 billion in January 2022. He believed the acquisition would not benefit shareholders and argued that the company overpaid for the asset. Southwest sold these assets for ~$1.5B less than two years later.

· Ichan launched a tender offer for Southwest shares, seeking to buy stock from other company shareholders at $82.50 each. Note that the stock trades are below this price two years later.

· On May 6, 2022, Southwest entered into a settlement agreement with Icahn, under which at least three and up to four new directors would join Southwest's Board. Icahn appointed Andrew W. Evans, H. Russell Frisby, Jr. (who resigned shortly after that and was replaced by Andrew Teno), and Henry P. Linginfelter.

Management

Much of the board and management is new due to the changes Ichan pushed for in 2022. Southwest is led by Karen Haller, whose CEO tenure started in 2022, and was previously executive VP and Chief legal and administrative officer. Insider ownership is relatively low at just 0.39% of shares outstanding. In May 2022, CFO Gregory Peterson announced his intention to resign from his CFO position. Note how close of a timeline this is to the ongoing changes at the board and CEO. I suspect Ichan pushed him out the door. Robert Stefani replaced him in November 2022.

Management's compensation is aligned with the business. Incentive compensation is based on utility-adjusted net income, productivity—defined as O&M expense per customer, customer satisfaction, and safety. 40% of the payout is based on utility net income. In comparison, 30% is O&M expense per customer. The company's ability to manage O&M/customers helps it achieve the net income target.

Risks

Rate base growth underwhelms

Operations & maintenance/customer expenses do not remain stable

Management uses CTRI cash to make an acquisition, which the company has a poor history of doing (previous management).

Carl Icahn disposes of his 15% stake, putting heavy selling pressure on the stock.

RRA (Regulatory Research Associates) rates Arizona’s state utility regulation environment the lowest of any state.

KPIs & Go Forward Metrics to Monitor

Rate base growth

O&M / Customer

Rate case filings

Sources

https://worldpopulationreview.com/state-rankings/fastest-growing-states

https://www.aterio.io/insights/us-population-forecast/az

https://www.aterio.io/insights/us-population-forecast/nv

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.census.gov/content/dam/Census/library/publications/2020/demo/p25-1144.pdf

https://www.forbes.com/best-states-for-business/list/#tab:overall

https://www.reviewjournal.com/business/entrepreneurs/the-elon-musk-effect-why-more-businesses-want-to-incorporate-in-nevada-3013235/

https://www.fox5vegas.com/2024/03/21/summerlin-residents-uneasy-about-traffic-movie-studio-gets-green-light/